Introduction

Financing is a critical component for businesses of all sizes, and choosing the right method of financing can be a challenge. There are many different types of financing available to businesses, each with its own advantages and disadvantages. Some businesses may choose to use multiple financing methods to achieve their goals. This Blog by Daryl […]

Bootstrap

Bootstrapping, also known as self-financing, is a method of funding a start-up with minimal boring. The company uses personal savings, credit cards, and revenue generated by the business. This approach allows entrepreneurs to avoid the pitfalls of borrowing from traditional lenders, such as banks and investors, and maintain complete control over their venture. The term […]

Factoring

A financing solution in which a business sells its accounts receivable, or outstanding invoices, to a factoring company at a discount in exchange for immediate cash. This provides businesses with a way to receive working capital without waiting for their customers to pay their invoices. Daryl Yurek says this is the absolute worst method of […]

Reverse Take Over (RTO)

An alternative to an initial public offering (IPO) for private companies to become publicly traded is through a process known as a reverse takeover (RTO). This involves the private company acquiring enough shares to gain control of a publicly-traded company and exchanging its shares for those of the public company, effectively becoming a publicly-traded entity. […]

Crowdfunding

Crowdfunding is a method of raising capital through the collective effort of a large number of individuals, typically through online platforms. There are several types of crowdfunding, including rewards-based crowdfunding, donation-based crowdfunding, and equity crowdfunding. Each type of crowdfunding is suited to different types of deals and offers unique benefits and drawbacks for both investors […]

Equipment leasing

Daryl Yurek says that equipment leasing is a great source of cash for a young company. It’s a financing option that allows businesses to use equipment without having to purchase it outright. Instead, the business leases the equipment from a leasing company and makes regular payments over a set period of time. The equipment vendor […]

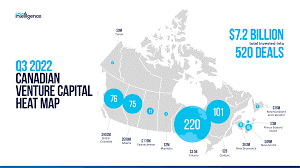

Foreign Venture Markets

Daryl Yurek thinks that venture markets and stock exchanges that support small and emerging companies are very interesting vehicles for small emerging companies in hot spaces like biotic and hi-tech. These exchanges offer lower listing requirements than larger, more established exchanges, making them more accessible to early-stage companies that may not yet meet the criteria […]

CPCs (Capital Pool Companies) and SPACs (Special Purpose Acquisition Companies)

According to Daryl Yurek, these companies are referred to as blind pools. Blind pools refer to two types of shell companies commonly used to raise capital and go public. The first type is Canadian shell companies, or CPCs, which are specifically created for the purpose of going public through a reverse takeover or a similar […]

Venture Exchanges

Daryl Yurek, the author, specializes in venture exchanges, which are exchanges that list the shares of small and growth-oriented companies. These exchanges, such as the TSX Venture Exchange, AIM market, and OTCQX and OTCQB markets, cater to companies that are too small to meet the listing requirements of larger exchanges like the NYSE or NASDAQ, […]

IPO

An IPO is the process by which a company raises capital by selling shares of its stock to the public for the first time. This allows the company to raise significant amounts of capital, while also giving investors the opportunity to buy shares of the company and potentially profit from its growth. The process of […]